Bitcoin has been trading within a tight range between $90,897.72 – $102,290 and continued trading in this zone before momentarily dipping to $89,800 during the late trading hours on January 13.

The overall cryptocurrency market cap dipped over 5%, marking one of the highest single-day dips this month.

After falling throughout the day, it had settled around $3.31 Trillion at press time.

Fear rippled across the cryptocurrency market as broader macroeconomic headwinds continued to suppress bullish momentum.

The slowdown was underscored by diminished trading volumes and a noticeable liquidity crunch.

The crypto fear and greed index was in the neutral zone and had dropped a point from the previous day, indicating that traders were becoming as they braced for major economic and political events anticipated in the coming weeks.

Why is Bitcoin going down?

A strong U.S. dollar and dwindling expectations of potential rate cuts by the Federal Reserve are the major catalysts that have prevented Bitcoin from stabilising above $100,000 over the past few days.

Traders tend to lose risk appetite when high interest rates make holding yield-bearing assets like the US Treasury more profitable.

Recent economic data has lent more weight to theories that suggest such a scenario is likely, with the CME Fed Watch tool putting chances of a cut at just 2.7%.

Latest economic data like the Jan. 10 Bureau of Labor Statistics report came in stronger than expected, with annual revisions showing the July unemployment peak, initially reported at 4.3%, was revised lower, signaling a stronger labour market during the summer.

Experts further add that upcoming macroeconomic data prints like the Consumer Price Index and Producer Price Index for December 2024 are expected to come in higher, which has also added to the current bearish momentum.

Will Bitcoin go up?

Bitcoin is down over 11% this month, which some pundits claim is within the historical norm, where the flagship crypto witnessed bigger drops in January during post-halving years. Notably, such corrections have led prices to pull back between 25-30% during the past two instances.

However, in both previous cases, the year ended with significant rallies that propelled BTC prices to a new all-time high.

Another angle to this was discussed by Youtuber Crypto Rover, who observed that the correction was more pronounced during the first half of January and described the current price action as a “small dip” compared to what the history book tells.

Despite the current gloom, some metrics suggest Bitcoin could be gearing up for a rebound soon.

First, Bitcoin exchange reserves have dropped to a 7-year low, according to CryptoQuant data.

According to experts, this is the result of institutional buyers such as businesses and hedge funds picking up the bellwether crypto at low prices or, more simply, buying the dip.

A drop in Bitcoin supply is viewed by many as a precursor to a “supply shock,” which often leads to strong rallies.

Second, the buy-sell ratio on crypto exchange Binance, which accounts for the largest chunk of the overall cryptocurrency trading volume, points to waning seller strength.

According to QuickTake blog analysts, this could signal an uptick in buying demand.

Further, Bitcoin inflows into exchanges have also dropped roughly 75% since peaking in November last year.

Experts like Darkfost believe that if this trend persists, it could extend the sideways movement or even spark the next leg up.

However, for Bitcoin’s rally to gain momentum and start recovering towards $100k, it needs a daily close above $91,000 per well-followed analyst Rekt Capital.

A close above this level would “preserve both the $91000-$101000 range and the early-stage Higher Low on the RSI,” the analyst noted in a January 13 X post.

Holding above this level would help prevent further downside towards previous support levels around $85k.

Nevertheless, most experts agree that a long-term target for Bitcoin well above the $100,000 mark remains in the picture.

When writing, Bitcoin was floating just above $91,700, down over 3% in the past 24 hours.

Altcoin market in peril

Altcoins continued to bear the brunt of Bitcoin’s price action.

Almost all of the top altcoins posted losses over the past 24 hours.

Bitcoin dominance has risen by over 1.5% in the past 24 hours, reaching 57.1%.

Typically, during altseason rallies, this metric tends to drop below 50%. Naturally, the altcoin season index slipped a point to 45, marking a monthly low.

The leading performers for the day were those who barely managed to hold on to the green side.

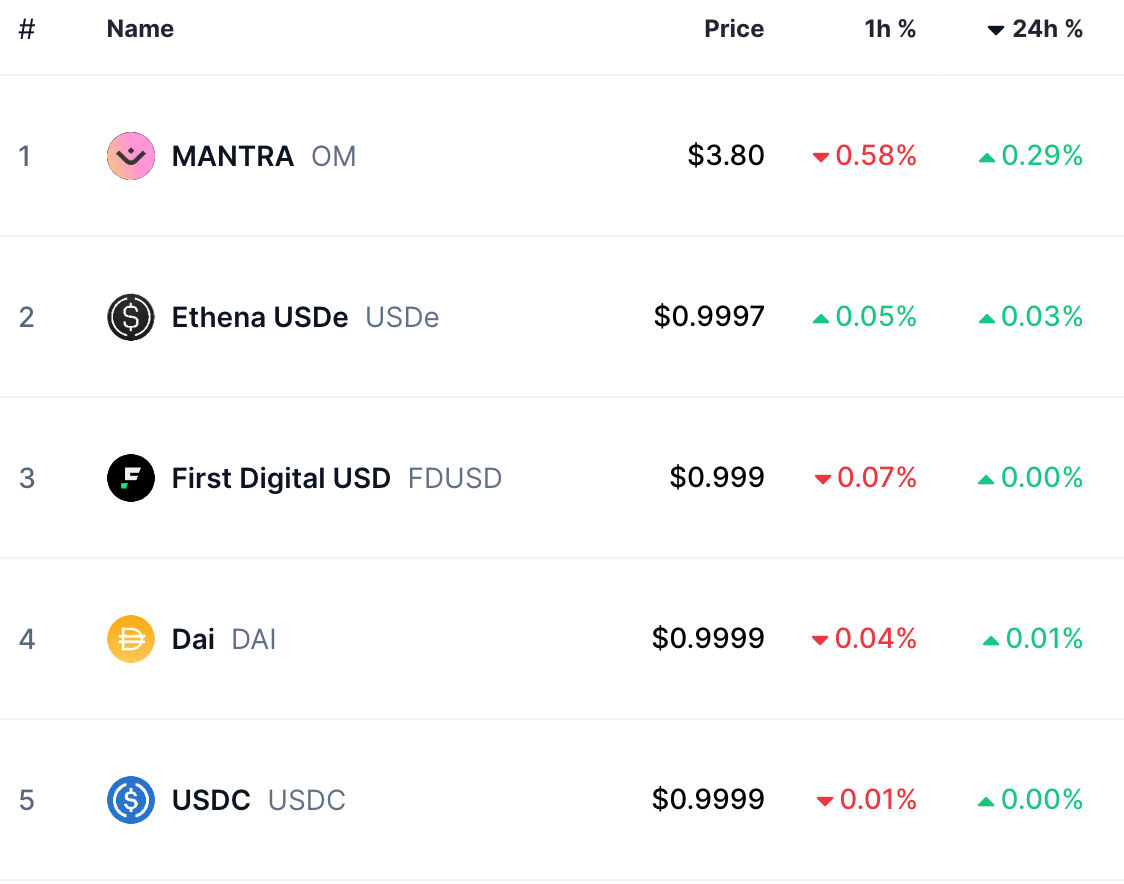

Mantra (OM) led daily gains with a mere 0.29% gain at press time.

Some stablecoins showed subtle price increases, which usually happens when more traders shift their holdings to these stable assets in anticipation of volatility or further downside. (See below)

Source: CoinMarketCap

Despite the current lull, analysts expect the onset of altseason during the 2025 bull run.

This, they suggest, will happen when Bitcoin hits a local top and starts consolidating while its market dominance falls.

The post Bitcoin’s on-chain metrics signal recovery ahead, altcoins face decline appeared first on Invezz