Bitcoin traded around the low 90s after failing to break the $96,000 resistance multiple times throughout the day.

With an intraday low of $93751, the leading cryptocurrency did little to help push the overall cryptocurrency market capitalisation towards this cycle’s high of roughly $4 trillion.

At press time, the market was down 3.32% in the past 24 hours, valued at $3.42 trillion.

Lacklustre performance was also witnessed across the altcoin market, with only one of the top 99 altcoins posting double-digit gains and most of the leading names dressed up in Christmas red.

The altcoin season index at 46 indicated that interest had waned as a result of Bitcoin’s poor performance and a slightly bearish sentiment prevailing in the market.

The apex crypto remained the dominating force, accounting for over 57% of the current market capitalisation.

Will Bitcoin rise again?

The Christmas season usually brings market gains, which traders refer to as the “Santa Rally.” But this year, it seems to be running late.

Hawkish remarks from Federal Reserve Chairman Jerome Powell last week are being touted as the primary reason why Bitcoin is having difficulties breaking past the six-figure mark again.

Meanwhile, there has been an uptick in profit-taking among long-term investors ever since BTC hit an all-time high (ATH) of $108,135.

Although major corporations like MicroStrategy and Japan’s MetaPlanet, along with El Salvador and whale investors, continued buying the dip, analysts cautioned that BTC may have entered a correction phase.

However, it’s important to note that experts have constantly reminded us that such corrections are healthy for extended rallies.

Bitcoin’s performance during previous bull runs also paints a similar picture, as the bellwether is known to correct as much as 20% after hitting a new ATH.

Prominent analyst Rekt Capital told his over 522k followers on X that BTC had recently confirmed a Bearish Engulfing candlestick formation on the weekly chart after losing a key support level.

According to the analyst, this can be considered a sign that the cryptocurrency is “transitioning into a multi-week correction.”

This correction phase could last a few more weeks, according to pseudonymous analyst Jelle Eyed, who pointed to historical price action.

On the contrary, Capriole Investments founder Charles Edwards offered a bullish perspective via another historical pattern.

Notably, December 26th, which is just three days away, is historically the best-performing day for the crypto market, with the highest daily gains. As such, he floated the idea of a potential “X-mas relief bounce.”

Trader Josh Rager, however, suggested Bitcoin could drop to $75,000, noting it’s in line with the typical 30% pullback seen during bull runs.

Upon writing, one BTC was selling for $93,260, and the price was down 2.1% in the past 24 hours.

Meanwhile, the leading gainers for the altcoin market at press time were:

Aave

Decentralised money market protocol Aave was the best-performing project for the day, with AAVE up 12.4% per cent in the past 24 hours.

Source: CoinMarketCap

With a market cap of over $5 billion, the token saw an uptick in trading activity, confirmed by its trading volume, which was up over 64.30% in the past 24 hours.

There was no particular reason behind the price surge, and the gains were part of a broader recovery across the defi sector. Strong technicals and retail buying also helped AAVE’s price action.

The altcoin has broken out of the $298 support level, and analysts expect prices to climb higher if Bitcoin trades sideways in the coming days and could potentially break its all-time high of $661,69 as early as the first quarter of 2025.

Virtuals Protocol

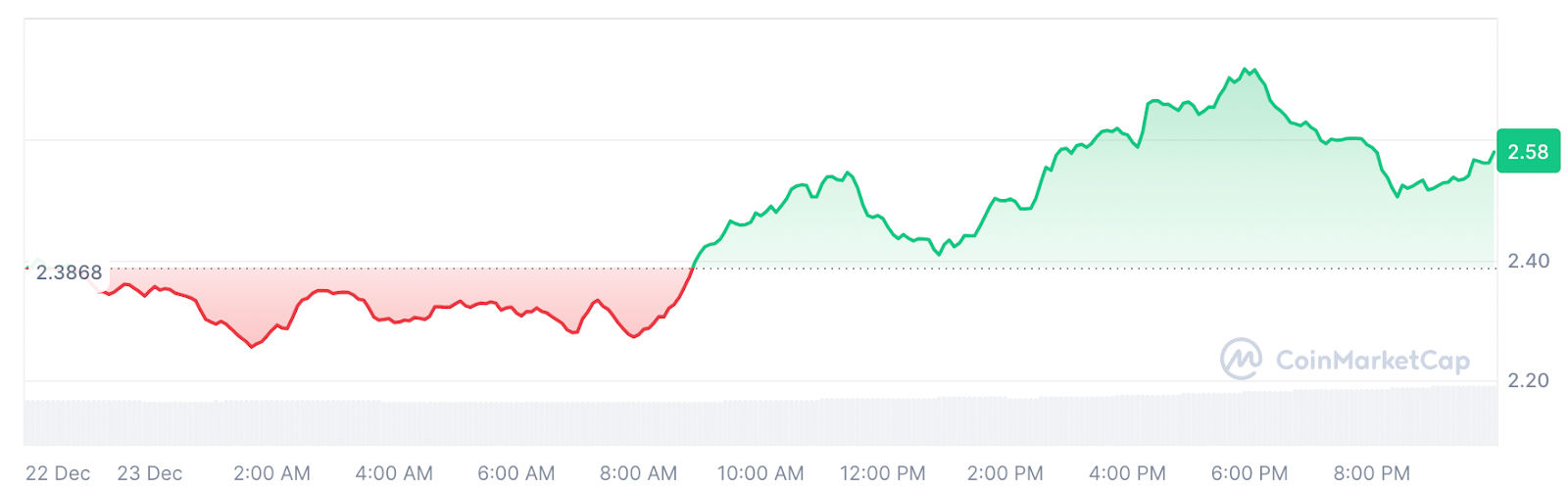

VIRTUAL, the native token for the AI agen launchpad Virtual s protocol, rallied over 8% in the past 24 hours to hit an intraday high of $2.72.

Source: CoinMarketCap

At press time, the altcoin held a market capitalisation of roughly $2.5 billion with a daily trading volume of a little over $300 million, which was up 29.70% in the past day.

With no particular protocol-related development driving the current rally, VIRTUAL continued to benefit from the hype around AI agents this season.

Users are required to lock the altcoin on the platform to launch AI agents, which fuels demand and helps push the token’s price.

Analysts remain positive over the token’s short-term prospects with some pointing to current price levels as a good entry point.

Long term targets for the token range from $8 to $10.

When writing, the token was trading at $2.58.

Raydium

Raydium (RAY) was up 6.7% in the past 24 hours, reaching a daily high of $4.66. Its total market capitalisation stood over $1.3 billion.

Source: CoinMarketCap

The native token for the decentralised exchange was also one of the benefactors of the defi market rebound.

The Solana-based dex has seen significant activity as a result of meme coins, leading to a surge in the price of RAY.

Tokens launched on the popular meme coin deployer Pump.fun have contributed to this increased activity.

Pump.fun allows users to create meme coins on the Solana blockchain, and once a token’s market cap reaches $69,000, liquidity is automatically added to Raydium.

This surge in meme coin activity has driven higher trading volumes on Raydium, boosting the platform’s fee revenue and staking rewards for RAY holders, thereby incentivising more traders to buy and stake the altcoin.

With meme coins booming, analysts expect the hype to continue, driving more demand for RAY and potentially pushing its price higher.

The post AAVE, VIRTUAL, RAY lead altcoin gains as Bitcoin correction looms appeared first on Invezz