Bitcoin traded under $95000 on Wednesday after failing to breach the resistance level multiple times.

Most of the top altcoins had a slow day and gains were mostly limited to small-cap tokens.

The overall cryptocurrency market capitalization remained on an upward trajectory and was up 2.7% in the past 24 hours at $3.41 trillion.

Much of the recent market inflow likely targeted altcoins, as the total altcoin market cap increased by over 3.7%.

Based on the Altcoin Season Index, which gauges the performance of the top 100 altcoins against Bitcoin over the past 90 days, the market appears to be edging toward an alt season.

The index climbed to 54, up from 52 in the previous period. A value above 75 confirms a full-fledged alt season.

This trend typically occurs when Bitcoin is consolidating or moving sideways. However, for a full-fledged alt season to materialize, Bitcoin dominance—currently at 57.1%—also needs to decrease.

Historically, during alt seasons, Bitcoin dominance tends to fall below 50%, which confirms a shift in investor focus toward altcoins.

Right now, Bitcoin remains the dominant force in the market despite its sluggish performance, which multiple analysts claim is due to profit-taking.

Why Bitcoin is falling?

Bitcoin’s current price action is being driven by selling across both retail and institutional markets.

Data published by Glassnode suggests short-term holders accounted for a lot of the recent sell pressure that was created after BTC rallied close to $100k last week.

This brought a lot of the holders, especially those that got in around the $30k price mark in profit.

As these short-term holders started taking profits some speculators also fell victim to liquidation events that added to the downward momentum.

Glassnode data indicated coins aged 6m-1y accounted for 35.3% of the sell side pressure, although it added that long-term sellers were not reducing their BTC exposure.

Some of the selling pressure also came from Wall Street with spot Bitcoin ETFs recording over $550 million in outflows over the past two days.

Bitcoin’s price dipped to $90,752 on November 27, but experts assert that such corrections are normal during bull runs and are often seen as healthy for a sustainable rally.

Without ruling out the short-term target of $100,000 analysts suggest that further corrections could be on the horizon, while others predict BTC may enter a consolidation phase in the coming weeks.

According to Bitget researchers, Bitcoin could correct by as much as 30%, potentially dropping the bellwether below $70,000 before continuing its rally.

Similarly, CryptoQuant CEO Ki Young Ju theorized a comparable scenario, noting that such a correction is typical but would not invalidate the current bull run.

Another scenario proposed by crypto analyst PlanC suggested that Bitcoin could consolidate in the $90,000 range, noting that this would be the best-case outcome for the longevity of the current bull market.

Most market pundits and analysts on X suggested that dips like these on the road to $100K are great buying opportunities.

At publication time, Bitcoin was trading at $95,580, up 2.7% in the past 24 hours.

The top altcoins for the day were:

Uniswap

Uniswap (UNI) was up 19.2%, reaching a six-month high of $12.92. Its market cap stood at $7.7 billion at press time, with the token witnessing an 8.10% increase in trading volume over the past 24 hours.

Source: CoinMarketCap

The rally had no immediate catalysts and appeared to be a continuation of the broader uptrend.

Much of the bullish momentum was driven by increased on-chain activity, heightened demand from investors, and anticipation surrounding the mainnet launch of Unichain—a layer-2 solution powered by Optimism’s Superchain and developed by Uniswap—expected to go live by late 2024 or early 2025.

Aave

Aave (AAVE) rallied over 17% in the past 24 hours and hit a six-month high of $205.

When writing, the defi protocol held a market cap of a little over $3.8 trillion.

Source: CoinMarketCap

Most of the day’s gains came after the project integrated new oracles from Chaos Labs to automate its risk management system.

This update is expected to optimize liquidity, enhance protocol stability, and deliver a more secure user experience for the blockchain network.

Lido DAO

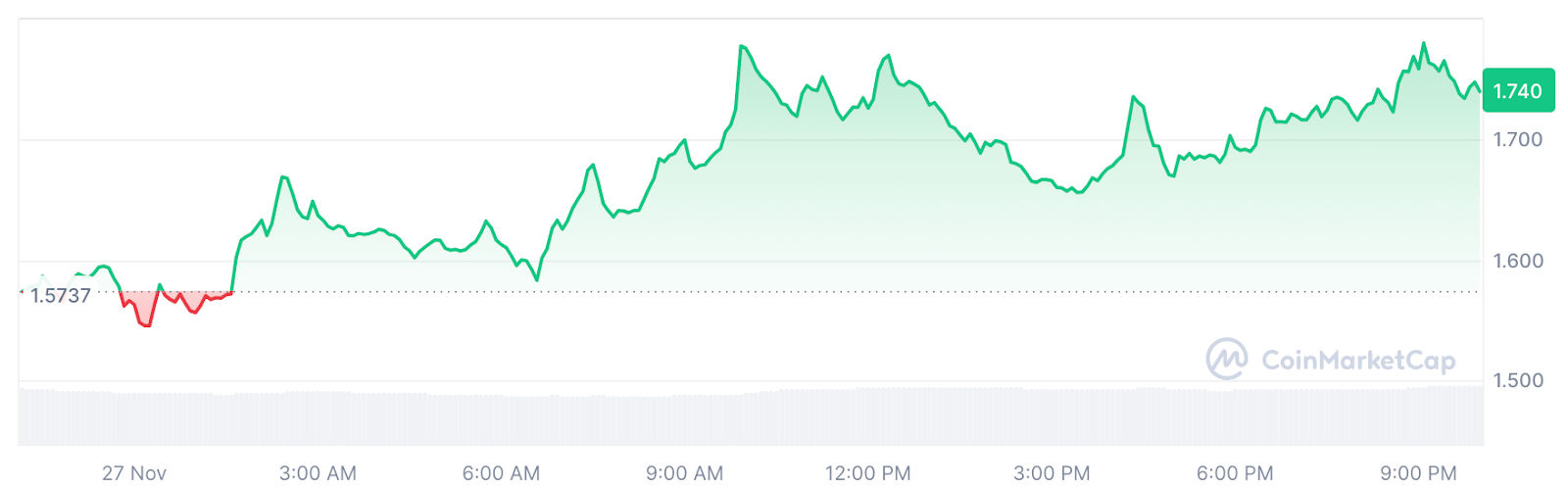

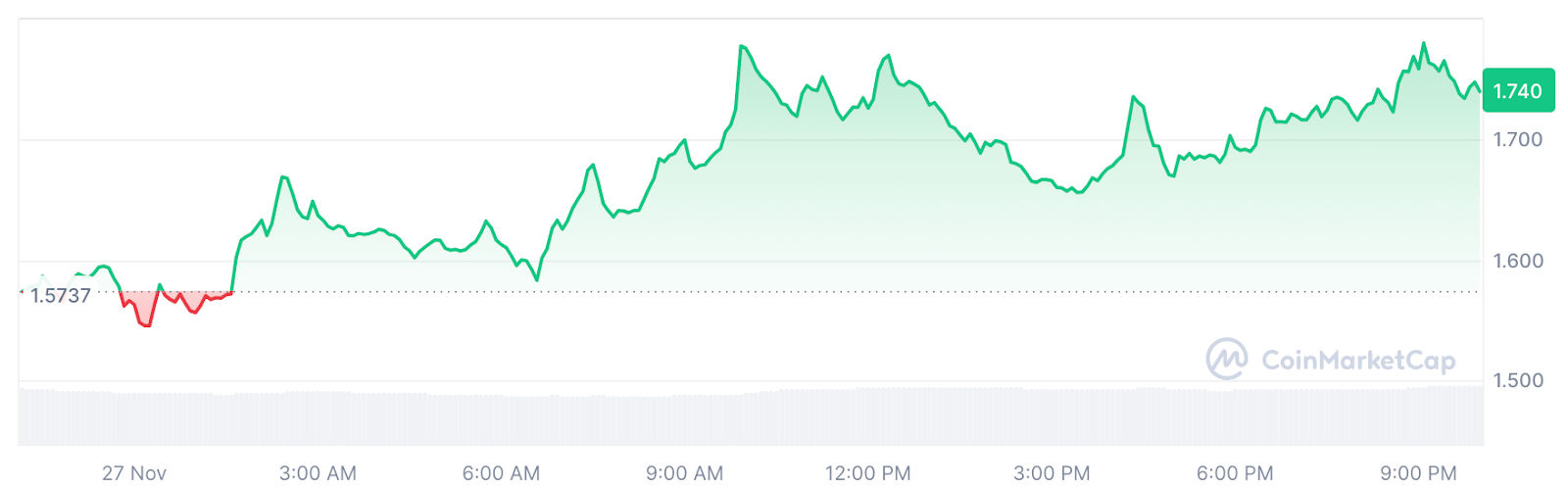

Lido DAO (LDO) posted 11.6% gains the past day after hitting a three-month high of $1.75.

The token’s market cap stood at $1.5 billion upon writing.

Source: CoinMarketCap

While there was no clear catalyst for LDO’s price surge, several analysts highlighted that the token is approaching the end of a multi-month accumulation phase, fueling optimism within the community and raising expectations for an imminent breakout.

The post UNI, AAVE, LDO lead daily gains as Bitcoin falls below $95K amid profit taking appeared first on Invezz